Tariff War Explained: Why They Matter More Than You Think in 2025

https://mrpo.pk/the-global-economic-storm-2025/

Trump issued a memo today aimed at authorising the Defence Department to use federal lands to bolster border security.

The memo expands on an executive order Trump signed on his first day in office that directed the nation’s armed forces to prioritise border security and for the Defence Secretary to assign USNORTHCOM the task of sealing the borders.

The memo directs the secretaries of defence, interior, agriculture and homeland security to take the necessary steps enabling the Pentagon “the use and jurisdiction” over federal lands for military activities, including building border barriers and installing detection and monitoring equipment.

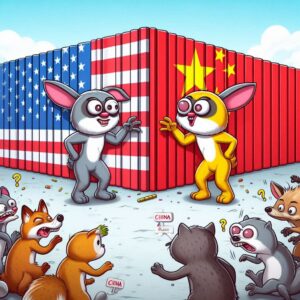

The recent escalation in tariff battles between the United States and China has reached unprecedented levels. As of April 2025, the U.S. has imposed a staggering 145% tariff on Chinese goods, while China has retaliated with 125% tariffs on American products[1]. These numbers aren’t just statistics—they represent a fundamental shift in global trade that affects everything from the price of your smartphone to the stability of your job. The ripple effects extend far beyond boardrooms and political summits, directly impacting everyday consumers, workers, and businesses worldwide.

History of US-China Trade Tensions Timeline

Trade friction or tariff war between the United States and China didn’t appear overnight. The seeds were planted during Donald Trump’s 2016 presidential campaign. He frequently mentioned China’s “unfair” trade practices and vowed to address them[5]. In January 2018, the first significant actions began when President Trump started imposing tariffs on Chinese goods[1].

The initial target was $50 billion worth of Chinese exports with a 25% tariff[1]. China quickly responded in kind. This back-and-forth continued throughout Trump’s first term. Each country kept raising the stakes with new tariffs and counter-tariffs.

By January 2020, the two sides reached what was called a “phase-one agreement”[1]. This provided temporary relief. However, the Biden administration maintained most of Trump’s tariffs during his presidency.

The situation dramatically intensified after Trump’s reinauguration in January 2025. On February 1, he increased tariffs on Chinese goods by 10%[1]. China responded with targeted tariffs on American energy products and large vehicles[3].

March brought another 10% increase from the U.S., raising the total to 20%[1]. China countered with tariffs on American agricultural goods, including chicken, wheat, and corn[1].

April witnessed an explosive escalation. Trump raised tariffs by an additional 34%, bringing the effective rate to 54%[1]. Within days, both countries engaged in a dizzying series of retaliatory increases. The U.S. eventually reached 145% tariffs on Chinese goods, while China imposed 125% on American products[1].

This rapid acceleration of the tariff war represents the most severe trade conflict between major economies in modern history. What started as campaign rhetoric has transformed into economic reality, affecting billions of people worldwide.

Understanding Tariffs and Their Economic Impact

Tariffs are essentially taxes on imported goods. When the U.S. imposes a 145% tariff on Chinese products, it means those items cost 145% more than their original price when entering America[1]. This dramatic increase makes Chinese goods less competitive in the U.S. market.

The primary purpose of tariffs is to protect domestic industries. By making foreign products more expensive, local companies can better compete. Take American steel manufacturers, for instance. When Chinese steel becomes pricier due to tariffs, U.S. steel companies may see increased sales.

However, tariffs create a complex economic domino effect. American companies that use Chinese components face higher costs. A furniture maker relying on Chinese materials must either absorb these costs or pass them to consumers. Either way, their business suffers.

Consumers ultimately bear much of the tariff war burden. When tariffs make imported goods more expensive, shoppers face higher prices at stores. A $500 television from China could potentially cost over $1,000 with current tariff levels.

Tariffs also trigger retaliatory measures. When America taxes Chinese imports, China responds by taxing American goods[1]. This hurts U.S. exporters trying to sell their products overseas. American farmers have been particularly vulnerable to Chinese retaliatory tariffs on agricultural products[1].

Another key effect is trade diversion. When U.S.-China trade becomes too expensive, businesses look for alternatives. Countries like Vietnam, Mexico, and Taiwan have seen increased exports to the U.S. as companies shift supply chains away from China[4].

The impact extends beyond prices. Tariffs create economic uncertainty, which can delay business investments and hiring decisions. They can also accelerate inflation by increasing production costs across multiple industries simultaneously.

Trump’s Tariff Strategy Revealed

President Trump’s approach to tariffs has evolved significantly since his first term. Initially focused on blanket tariffs, his administration has now shifted toward what they call “reciprocal tariffs”[2]. This strategy aims to match the exact tariff rates other countries impose on American goods.

The fundamental principle is straightforward: if China charges 10% on American cars, America will charge exactly 10% on Chinese vehicles[2]. Trump views this as creating a level playing field rather than starting a trade war.

In February 2025, the White House released a memorandum outlining this approach. Officials were instructed to evaluate not just explicit tariffs but also value-added taxes and non-tariff barriers[2]. These include regulatory standards, subsidies, and currency policies that might disadvantage American companies.

Trump’s team is conducting a comprehensive assessment of all trading relationships. The president has given his staff 180 days to compile this information[2]. This suggests a methodical approach rather than impulsive decision-making.

The administration believes this strategy will be less harmful to American consumers than universal tariffs. When faced with targeted tariffs, importers have multiple options. They can absorb the costs, pass them to consumers, or find suppliers from non-tariffed countries[2].

Trump has successfully used tariff threats as negotiating tools. When he threatened 25% tariffs on Mexico and Canada, both countries quickly addressed his border security concerns[2]. This pattern demonstrates how tariffs function as leverage in international negotiations.

The strategy also serves domestic policy goals. Tariffs generate revenue that could help address budget deficits[2]. Trump fundamentally views trade deficits as unfair and seeks to tax countries that sell more to America than they buy.

Despite the administration’s confidence, April’s rapid escalation to 145% tariffs suggests the strategy may have limits. What began as reciprocal tariffs has transformed into something far more confrontational and potentially damaging to global trade.

How China Responds to Trade Pressure Today

China’s response to Trump’s tariffs has been calculated and strategic. Unlike the aggressive approach seen during the initial trade war, Beijing now exhibits greater caution[3]. This reflects China’s challenging economic position, with slowing growth and manufacturing deflation limiting its options.

When Trump imposed 10% tariffs in February 2025, China’s retaliation was measured. They targeted specific American sectors rather than implementing across-the-board increases[3]. For instance, they applied 15% tariffs on coal and liquified natural gas, while placing 10% tariffs on crude oil and agricultural machinery[1].

Another notable aspect of China’s strategy is the delayed implementation. When announcing retaliatory measures in early 2025, China gave a five-day grace period before tariffs took effect[3]. This created room for potential negotiations, similar to how Mexico and Canada secured tariff exemptions through diplomatic channels.

Beyond tariffs, China has employed other economic tools. They’ve implemented limited export controls on critical minerals without imposing a complete ban[3]. They’ve also launched antitrust investigations against American companies like Google[3]. These moves provide additional leverage without escalating the tariff situation further.

However, as tensions escalated dramatically in April 2025, China’s measured approach gave way to more substantial responses. When Trump raised tariffs to 54%, China quickly announced a 34% countermeasure[1]. The subsequent rapid-fire increases culminated in China’s 125% tariff on all American goods[1].

Chinese officials have emphasised protecting their economic interests while maintaining global trade stability. They’ve positioned themselves as defenders of the multilateral trading system against American unilateralism. This narrative aims to gain support from other countries affected by U.S. trade policies.

A crucial element of China’s strategy involves diversifying its trade relationships. They’ve accelerated trade agreements with Asian neighbours, European partners, and countries participating in the Belt and Road Initiative. This reduces their vulnerability to American pressure while creating alternative markets for Chinese exports.

Winners and Losers in International Trade Conflicts

Every trade war creates unexpected victors and casualties. Countries that aren’t directly involved often find new opportunities amid the chaos. Vietnam, Mexico, and Taiwan have emerged as significant beneficiaries of the US-China conflict[4].

Vietnam’s manufacturing sector has boomed as companies relocate production from China. In 2019 alone, Vietnam saw exports to the U.S. increase by billions of dollars[4]. A factory owner in Hanoi described it as “Christmas coming early” when American companies began frantically seeking non-Chinese suppliers.

Mexico has capitalised on its proximity to the American market. Its motor vehicle exports to the U.S. increased by $5 billion as Chinese alternatives became prohibitively expensive[4]. Taiwan similarly boosted exports by $4.8 billion, particularly in electronics and machinery[4].

Among the most significant losers are American consumers. Higher tariffs translate directly to increased prices for everyday goods. A typical American family faces hundreds or potentially thousands of dollars in additional annual costs due to tariffs.

American farmers have endured severe hardships. China’s retaliatory tariffs on agricultural products like soybeans, corn, and pork have devastated rural communities[1]. Many farmers who spent decades building relationships with Chinese buyers saw their market vanish overnight.

Manufacturing companies with complex supply chains suffer from increased costs and uncertainty. An American furniture maker using Chinese components, Mexican assembly, and Canadian materials faces disruption at every production stage.

Paradoxically, some protected industries don’t benefit as much as expected. American steel producers initially cheered tariffs on Chinese steel, but many have still struggled. The broader economic slowdown caused by trade tensions reduced overall demand for their products.

Multinational corporations face difficult strategic decisions. Companies with significant Chinese manufacturing must consider expensive relocation. Businesses with large Chinese markets risk losing access to billions of potential customers.

The global economy as a whole loses from reduced efficiency and increased friction. The natural comparative advantages that drive beneficial trade are artificially distorted, creating widespread economic waste and missed opportunities.

Global Supply Chain Disruptions Explained

The modern economy relies on intricate global supply chains developed over decades. A single product might contain components from dozens of countries. The iPhone, for example, includes parts from China, Japan, South Korea, and elsewhere before final assembly.

Tariffs throw this delicate system into disarray. When the cost of moving goods between the U.S. and China suddenly increases by 145%, companies must completely rethink their operations[1]. This creates what economists call “trade diversion”—the rapid reorganisation of trade flows away from their natural paths[4].

The pandemic had already stressed global supply chains. The tariff war compounds these challenges. Companies now face what one logistics executive called “the perfect storm of disruption.” Manufacturing facilities built specifically for certain supply chains cannot be easily repurposed.

Many businesses are implementing “China plus one” strategies. They maintain some Chinese production while establishing alternative facilities in countries like Vietnam, Mexico, or India. This hedges against further trade escalation but increases overall production costs.

The automotive industry demonstrates these disruptions clearly. Cars contain thousands of parts from numerous countries. A Midwest auto parts supplier recently explained: “We’re playing three-dimensional chess with our supply chain now. Every component has multiple backup sources from different countries.”

Technology companies face particularly complex challenges. Semiconductor production involves global collaboration that’s difficult to disentangle. Moving these sensitive supply chains requires years of planning and billions in investment.

Smaller businesses often suffer most acutely. Without the resources to quickly reconfigure their supply chains, many face existential threats. A family-owned electronics importer in Chicago recently shut down after 30 years because tariff costs made their business model unviable.

The environmental impact of supply chain restructuring is substantial but often overlooked. New factories, increased transportation distances, and redundant facilities all contribute to higher carbon emissions. An efficient global system optimised over decades is being replaced by a more fragmented, less efficient alternative.

These disruptions create both immediate costs and long-term strategic changes. Even if tariffs were removed tomorrow, many companies would maintain their diversified supply chains. The psychological impact of trade uncertainty will influence business planning for years to come.

Consumer Impact of Rising Import Taxes

The average American might not follow trade policy news, but they certainly notice prices increasing at stores. Tariffs create a direct pipeline from international policy to personal budgets. With current tariff levels reaching 145% on Chinese goods, consumers face unprecedented price pressures[1].

Everyday items show the clearest impact. A visit to any retail store reveals the reality. Clothing, electronics, furniture, toys, and household goods predominantly come from China. A family furnishing a new apartment might spend thousands more than they would have before the tariff escalation.

Electronics demonstrate this vividly. Smartphones, laptops, and televisions contain numerous Chinese components. An electronics store manager in Dallas explained: “Customers experience sticker shock daily. A TV that cost $400 last year now approaches $700. They blame us, but it’s the tariffs.”

Essential products aren’t exempt. Children’s products, including car seats, cribs, and clothing, face significant price increases. A parent in Seattle shared: “We’re expecting our first child, and baby products cost nearly double what my friends paid two years ago.”

Lower-income households suffer disproportionately. They spend a higher percentage of their income on physical goods, many imported from China. While wealthier Americans might absorb higher prices, working families make difficult choices between necessities.

The timing compounds economic challenges. With inflation already pressuring household budgets, tariff-driven price increases create additional strain. A recent consumer survey showed 64% of Americans have postponed major purchases specifically because of tariff-related price increases.

Some consumers actively seek non-Chinese alternatives. This benefits manufacturers in other countries, but often at higher prices. American-made products gain a competitive advantage but typically cost more due to higher labour expenses. Mexican and Vietnamese alternatives have increased market share but also raised prices in response to higher demand.

Retailers face complex inventory decisions. Should they stock higher-priced Chinese goods or switch to alternatives? Many maintain multiple price tiers, but shelf space limits options. Some retailers have introduced “tariff surcharges” as separate line items on receipts, attempting to educate consumers about price increases.

The psychological impact extends beyond actual price changes. Consumer confidence suffers amid economic uncertainty. People delay purchases, fearing further price increases or worrying about job security in affected industries.

Business Strategies During Trade Wars Demystified

Companies caught in the crossfire of tariff conflicts must develop sophisticated survival strategies. Their approaches vary based on size, industry, and international exposure. Some find creative opportunities while others fight for survival.

Large multinational corporations typically pursue geographic diversification. Apple exemplifies this approach, gradually shifting some production from China to India and Vietnam. This requires substantial investment but reduces vulnerability to any single trade relationship.

Many businesses absorb tariff costs initially while developing longer-term solutions. A furniture manufacturer described their phased approach: “First six months, we accepted lower margins. Next year, we redesigned products using alternative materials. Now we’re relocating production entirely.”

Some companies leverage tariff exclusion processes. The U.S. government allows businesses to request specific exemptions for certain products. This creates opportunities for regulatory specialists who help navigate complex application procedures. One consultant noted: “Companies with resources to hire experts gain significant advantages in securing exemptions.”

Smaller businesses often form new partnerships to share costs and expertise. Industry associations have created “tariff response groups” where companies collaborate on supply chain solutions. A kitchenware importer explained: “Individually, we couldn’t afford to move production from China. Together with five competitors, we established a shared facility in Thailand.”

Price strategies require careful calculation. Companies must determine how much tariff cost they can pass to customers without losing market share. Many implement tiered pricing, offering premium non-Chinese alternatives alongside tariffed Chinese products at different price points.

Some businesses completely reimagine their models. A toy company previously importing finished products now imports unassembled components from multiple countries. By completing final assembly in America, they reduce tariff exposure while marketing their products as “assembled in the USA.”

Inventory management becomes increasingly complex. Businesses must balance having sufficient stock against the risk of tariff changes rendering inventory uncompetitive. Many operate with smaller, more frequent shipments despite higher logistics costs.

Domestic manufacturers sometimes benefit substantially. An American textile producer shared: “After decades of losing to Chinese competitors, we’re expanding production and hiring for the first time in twenty years.” However, if they use imported materials, they may still face higher input costs.

The most forward-thinking companies recognise that trade tensions likely represent a permanent shift rather than a temporary disruption. They’re building flexibility and geographic diversity into their fundamental business models, prepared for continued trade uncertainty.

Future Outlook for US-China Trade Relations Forecast

The trajectory of US-China trade relations appears increasingly uncertain and potentially dangerous. The rapid escalation to 145% U.S. tariffs and 125% Chinese tariffs within just months of 2025 suggests a relationship spiralling toward greater conflict[1].

Economic analysts project several possible scenarios. The optimistic view suggests current tensions represent negotiating tactics rather than permanent policy. Historical patterns show both countries eventually find pragmatic compromises despite harsh rhetoric. The phase-one agreement during Trump’s first term demonstrates this possibility[1].

However, current circumstances differ significantly from previous tensions. The escalation speed in early 2025 exceeds anything seen before. When China announced its intention to ignore further American tariffs because “it has already become impossible for the Chinese market to accept U.S. imports at the current tariff levels,” it signalled a fundamental breakdown in normal trade relations[1].

The broader context suggests deeper structural conflict beyond tariffs. Technology competition, national security concerns, and strategic rivalry drive a comprehensive decoupling process. The trade relationship appears to be transitioning from economic interdependence to strategic competition.

Business leaders increasingly plan for long-term separation rather than reconciliation. A survey of multinational executives showed 78% believe the U.S. and China will maintain high tariffs for at least five years. Companies accelerate supply chain reorganisation accordingly, creating facts on the ground that will persist regardless of future policy changes.

Political dynamics in both countries complicate resolution prospects. American public opinion has shifted dramatically against China, with bipartisan support for tough positions. Chinese leadership views economic self-sufficiency as a national security imperative. These domestic pressures limit flexibility for both governments.

The global trade architecture faces existential challenges from this conflict. The World Trade Organization’s dispute resolution mechanisms have proven inadequate for tensions of this magnitude. Regional trade agreements increasingly form around either American or Chinese spheres of influence, potentially creating a bifurcated global economy.

Technology decoupling represents perhaps the most consequential aspect of future relations. Separate supply chains, standards, and ecosystems for critical technologies like semiconductors, telecommunications, and artificial intelligence are emerging. This technological separation could persist for generations.

Financial markets remain vulnerable to sudden escalations. Each tariff announcement in 2025 triggered significant market volatility. Continued uncertainty threatens global financial stability, particularly if the conflict expands to currency policies or financial sanctions.

The most worrying scenario involves escalation beyond economic measures. Trade conflicts historically correlate with broader geopolitical tensions. The risk of economic competition expanding into other domains remains a serious concern for global stability.

Economic Consequences for the World Economy Analysis

The tariff war between the world’s two largest economies creates ripple effects throughout the global economic system. With combined tariffs exceeding 250%, the US-China trade relationship has effectively collapsed[1]. This unprecedented situation has far-reaching implications for countries everywhere.

Global growth forecasts have been repeatedly revised downward. The IMF recently adjusted its world economic growth projection from 3.4% to 2.8%, citing US-China trade tensions as the primary factor. These aggregate numbers mask more severe impacts in certain regions and sectors.

Trade diversion represents both opportunity and disruption. Countries like Vietnam have seen manufacturing exports surge as production relocates from China[4]. However, this rapid industrialisation creates infrastructure strains and labour market pressures. A Vietnamese factory owner described it as “trying to build a decade’s worth of capacity in two years.”

Supply chain restructuring generates significant transition costs. Global companies will spend an estimated $1.2 trillion reorganising production networks over the next five years. These expenses reduce investment in research, development, and productivity improvements.

The agricultural sector demonstrates particular vulnerability. American farmers lost substantial Chinese market share due to retaliatory tariffs[1]. Meanwhile, Brazilian and Argentinian agricultural producers have expanded exports to China. These shifting patterns create winners and losers within countries and regions.

Developing economies face difficult strategic choices. Many must decide whether to align with the American or Chinese economic spheres. This growing bifurcation threatens the integrated global trading system that facilitated development for many emerging economies.

Inflation pressures have increased globally. Higher tariffs directly raise consumer prices in the US and China, but indirect effects spread worldwide. Production relocation increases costs as new facilities operate less efficiently than established ones. Transportation expenses rise as supply chains become less optimised.

Investment uncertainty delays capital expenditures across multiple industries. Business leaders hesitate to commit resources amid unpredictable policy environments. This reduced investment slows productivity growth and limits future economic potential.

The trade conflict exacerbates existing economic challenges. Pandemic recovery, climate transition, and technological disruption have already created significant adjustment pressures. The added burden of trade conflict makes addressing these fundamental challenges more difficult.

International economic cooperation has deteriorated substantially. Institutions like the World Trade Organization, G20, and international financial organizations struggle to manage conflicts between their largest members. This institutional weakness reduces the capacity to address other global economic challenges.

The most profound long-term consequence may be accelerated economic fragmentation. After decades of globalisation built around efficiency and comparative advantage, the world economy appears to be reorganising around security considerations and strategic competition. This shift promises a less efficient, more expensive economic future for consumers and businesses worldwide.

Understanding Tariff War Psychology and Motivations

Beyond economics, understanding tariff wars requires examining the psychological and political forces driving decisions. Leaders in both countries respond to complex incentives beyond pure economic calculation. These motivations help explain why seemingly irrational economic policies persist.

For American policymakers, trade deficits represent more than economic statistics. They symbolise perceived unfairness and national decline[2]. Trump’s statements consistently frame trade deficits as America being “ripped off” rather than as natural economic outcomes. This narrative resonates emotionally with many voters who connect trade imbalances to personal economic challenges.

National security concerns increasingly influence trade policies. A senior American official recently explained: “Economic security is national security.” The memory of pandemic-related supply shortages reinforced beliefs that dependence on China creates vulnerability. This security mindset justifies economic inefficiency for strategic independence.

Chinese leaders similarly view trade through broader strategic lenses. Economic self-sufficiency represents a core goal of current Chinese policy. Having studied how economic pressure affected their development historically, the Chinese leadership prioritises reducing foreign dependence even at a significant short-term cost.

Domestic politics shapes both countries’ positions. American politicians from both parties compete to appear tough on China. A congressional staffer noted: “No one loses votes by being hard on China.” Similarly, Chinese leadership cannot appear weak in response to American pressure without risking nationalist backlash.

Business constituencies influence policy direction. American manufacturers damaged by Chinese competition lobby for protection. Meanwhile, retailers and importers push for tariff reductions. These competing interests create complex political calculations beyond simple economic optimisation.

Historical grievances play important roles, particularly in China. The memory of colonial humiliation remains powerful in Chinese political culture. Trade demands from Western countries trigger associations with historical periods when China was forced into unfavourable treaties.

Psychological concepts like loss aversion help explain escalation patterns. Once tariffs are implemented, removing them feels like conceding defeat rather than returning to normal. This makes de-escalation politically difficult even when economically beneficial.

Media ecosystems in both countries reinforce confrontational approaches. News coverage emphasises conflict and often simplifies complex economic relationships. Social media amplifies the most aggressive voices, creating perceived public demand for tough positions.

Understanding these psychological and political factors helps explain why trade conflicts often defy economic logic. Pure cost-benefit analysis would suggest compromise, yet the conflict continues to escalate[1]. These non-economic factors may ultimately determine whether resolution becomes possible.

What the Tariff War Means for Your Future

The abstract concept of tariff wars becomes concrete when we consider their implications. For the average person, these trade conflicts will shape economic opportunities, consumer choices, and even career paths for years to come.

Your shopping experience has already changed. Walk through any store and you’ll notice higher prices on countless items[1]. A retail analyst explained: “We’re seeing the most significant consumer price reset in a generation.” This trend will continue as tariffs work through supply chains and alter product availability.

Your career prospects face new uncertainty and opportunity. Industries with significant Chinese connections—from technology to furniture—experience disruption. Meanwhile, some domestic manufacturing sectors gain protection and expand. A factory in Michigan recently added 300 jobs producing components previously imported from China.

Your investments reflect this shifting landscape. Stock markets have grown increasingly volatile with each tariff announcement[1]. Certain sectors show particular sensitivity. An investment advisor noted: “We now analyse company supply chains as carefully as their financial statements when making recommendations.”

Your taxes and government services connect directly to trade policy. Tariffs generate government revenue but potentially reduce overall economic activity[2]. This creates complex fiscal tradeoffs affecting tax rates and public services. Additionally, billions in agricultural subsidies have been implemented to support farmers affected by Chinese retaliatory tariffs[1].

Your community may be transformed by these global forces. Towns dependent on agricultural exports to China have suffered severe economic damage[1]. Conversely, areas attracting reshored manufacturing see new investment. A mayor from South Carolina described watching her town “transform almost overnight” after a manufacturer relocated production from China.

Your education and skill development choices face new considerations. As supply chains reorganize, demand shifts for different capabilities. Advanced manufacturing, logistics management, and regulatory compliance expertise have grown increasingly valuable. Meanwhile, businesses focused on the US-China trade intermediation struggle.

Your technology products will likely change significantly. The innovation ecosystem built around global collaboration faces disruption. Future devices may reflect increasingly separate American and Chinese technology standards and supply chains.

Even your food shopping reflects these trade dynamics. Agricultural products subject to retaliatory tariffs, like soybeans, pork, and fruits, face market disruptions affecting prices and availability[1]. American farmers have lost significant Chinese market share, altering agricultural production patterns domestically.

Understanding these personal connections to international trade policy helps clarify why tariff wars matter beyond abstract economic debates. These conflicts reshape daily life in countless subtle and significant ways, affecting everything from job opportunities to shopping options to community stability.

Conclusion: Why the Tariff War Demands Your Attention

Tariff war represents far more than abstract policy disputes between distant governments. As we’ve seen throughout this exploration, the escalating conflict between the United States and China fundamentally reshapes the economic landscape, affecting every aspect of daily life.

The dramatic acceleration in 2025, with tariffs now at 145% from America and 125% from China, marks unprecedented territory in modern trade relations[1]. What began as targeted measures has evolved into comprehensive economic confrontation. The consequences extend far beyond borders or balance sheets.

From higher prices at stores to shifting job opportunities, from investment volatility to community transformation, these trade policies directly impact personal finances and future prospects. Understanding these connections empowers better personal and business decisions amid uncertainty.

The global economy itself stands at a crossroads. Decades of increasing integration and efficiency now yield to concerns about security, self-sufficiency, and strategic competition. This transition promises lasting consequences for economic growth, innovation, and international cooperation.

Business leaders navigate this changing landscape by diversifying supply chains, adjusting pricing strategies, and reconsidering fundamental operational models. The most successful adapt quickly while maintaining long-term strategic vision despite short-term disruptions.

Policymakers face complex tradeoffs between economic efficiency, strategic security, and political imperatives. Their decisions shape not just current conditions but the architecture of international economic relations for generations to come.

For ordinary citizens, staying informed about these developments provides practical benefits. Understanding how global trade disputes affect local conditions enables better financial planning, career decisions, and community engagement.

The future remains uncertain. Resolution requires addressing deep structural issues beyond simple tariff rates. Technology competition, security concerns, and fundamental values differences complicate any potential settlement. Yet history shows even the most intractable economic conflicts eventually find equilibrium.

What remains clear is that tariff wars matter more than most people recognise. Their effects touch every aspect of modern life, from shopping carts to job markets, from investment accounts to community stability. By understanding these connections, we become better equipped to navigate an increasingly complex economic landscape shaped by the decisions of Washington and Beijing.

Citations:

[1] https://en.wikipedia.org/wiki/China%E2%80%93United_States_trade_war

[2] https://www.forbes.com/sites/garthfriesen/2025/02/17/winners-and-losers-in-trumps-reciprocal-tariff-strategy

[3] https://foreignpolicy.com/2025/02/04/china-tariffs-trump-export-controls-de-minimis/?tpcc=recirc_latest062921

[4] https://su.diva-portal.org/smash/get/diva2:1865800/FULLTEXT01.pdf

[5] https://www.straitstimes.com/world/united-states/timeline-key-dates-in-the-us-china-trade-war

[6] https://www.aa.com.tr/en/economy/trade-wars-weak-growth-geopolitical-challenges-global-economy-faces-risks-in-2025/3432889

[7] https://en.wikipedia.org/wiki/Trump_tariffs

[8] https://www.bastillepost.com/global/article/4720854-china-strikes-back-with-flurry-of-countermeasures-making-us-tariff-war-hit-wall-again-commentary

[9] https://www.cfr.org/backgrounder/contentious-us-china-trade-relationship

[10] https://thediplomat.com/2024/05/no-china-us-trade-war-this-year-but-uncertainty-ahead-in-2025/

[11] https://www.pbs.org/newshour/economy/trump-favors-huge-new-tariffs-how-do-they-work

[12] https://www.businessinsider.com/china-tariffs-trump-canada-mexico-trade-war-2025-2

[13] https://www.youtube.com/watch?v=C5IoFIPVLR4

[14] https://www.rfa.org/english/news/china/tariffs-harris-trump-biden-more-than-60-09042024142328.html

[15] https://www.alwihdainfo.com/China-s-countermeasures-in-the-trade-war-are-justifiable-legitimate-experts_a65792.html

[16] https://www.imf.org/en/Blogs/Articles/2019/05/23/blog-the-impact-of-us-china-trade-tensions

[17] https://www.scmp.com/economy/global-economy/article/3177652/us-china-trade-war-timeline-key-dates-and-events-july-2018

[18] https://rhg.com/research/us-china-trade-war-volume-2/

[19] https://en.wikipedia.org/wiki/Trump_tariffs

[20] https://www.euronews.com/business/2025/04/04/china-imposes-retaliatory-34-tariff-on-imports-of-all-us-goods

[21] https://www.nber.org/digest/202204/how-us-china-trade-war-affected-rest-world

[22] https://www.china-briefing.com/news/the-us-china-trade-war-a-timeline/

[23] https://www.bbc.com/news/business-45899310

[24] https://www.cnbc.com/2024/09/13/what-trump-tariff-proposals-would-mean-for-your-money.html

[25] https://www.youtube.com/watch?v=54JCkzZJ3Zc

[26] https://www.shs-conferences.org/articles/shsconf/pdf/2024/01/shsconf_icdeba2023_03017.pdf

[27] https://fortunly.com/statistics/us-china-trade-war/

[28] https://www.brookings.edu/articles/u-s-china-economic-relations-implications-for-u-s-policy/

[29] https://www.brookings.edu/articles/us-china-relations-in-2024-are-stabilized-but-precarious/

[30] https://www.dailysabah.com/business/economy/trade-wars-sluggish-growth-global-economy-faces-risks-in-2025

[31] https://www.indiatoday.in/business/story/china-us-tarifff-trade-war-actions-impact-all-factors-explained-2675093-2025-02-05

[32] https://en.wikipedia.org/wiki/China%E2%80%93United_States_trade_war

[33] https://carnegieendowment.org/research/2024/10/us-china-relations-for-the-2030s-toward-a-realistic-scenario-for-coexistence?lang=en

[34] https://www.forbes.com/sites/nicksargen/2025/02/03/trumps-trade-war-threatens-the-global-economy-and-markets

[35] https://www.cbsnews.com/news/trump-tariffs-proposal-10-percent-1700-cost-per-us-household/

[36] https://www.cfr.org/report/chinas-stockpiling-and-mobilization-measures-competition-and-conflict

[37] https://carnegieendowment.org/posts/2021/09/the-us-china-trade-war-has-become-a-cold-war?lang=en

[38] https://www.csis.org/analysis/us-china-relations-2024-managing-competition-without-conflict